SUI Cryptocurrency Rises 27.4%: USDC Boost & Insider Fears

The SUI cryptocurrency has grown by a solid 27.4% over the past week and 15.2% this month. The coin tested the $2,37, but this week, there was an almost 13% price rollback.

Circle’s USDC Boosts SUI Ecosystem

The key reason for the growth is the support of the stablecoin issuer Circle for the native USDC in the main network of the level 1 blockchain platform.

As experts explain, before the launch of USDC natively on Sui, the ecosystem used a version of USDC connected from Ethereum via Wormhole.

Now, Sui developers and users no longer need to connect the stablecoin, and they can use it for decentralized financial protocols (DeFi), games, decentralized physical infrastructure networks (DePINs), and non-fungible tokens in the Sui ecosystem.

Accordingly, the DeFi portal Llama believes that this news can lead to an increase in SUI network activity.

Insider Token Sales Rumors Affect Market Sentiment

Meanwhile, the bulls’ joy was marred this week, when information appeared about the alleged sale of SUI tokens for a total of $400 million by insiders. This forced the Sui Foundation to publish a refuting statement, but this information still spoiled the general mood of traders.

Analysts Warn of Risks From Token Unlocking

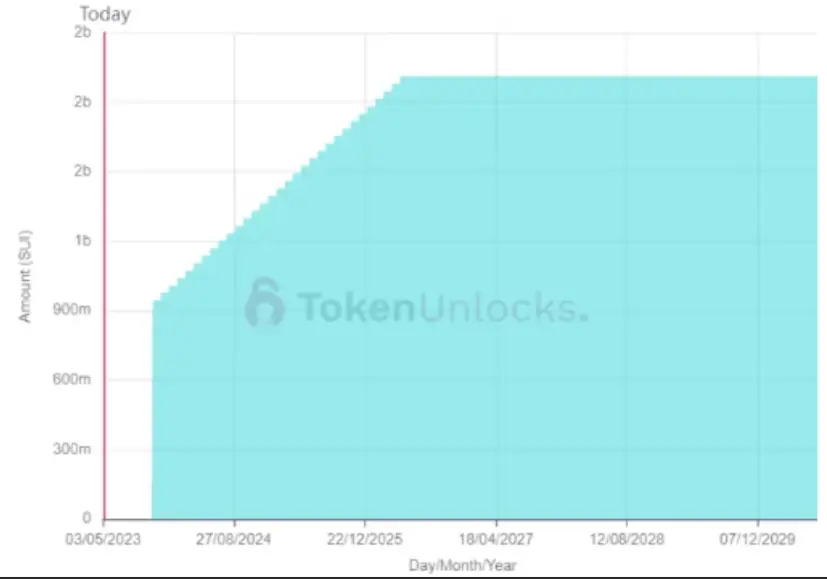

Fundamentally, analysts studying SUI talk about the risks associated with unlocking coins purchased at token sales as part of the Initial DEX Offering (IDO).

The SUI coin, they were held on the Binance, KuCoin, BitForex, OKX, and ByBit exchanges.

Experts fear that as part of the unlocking, holders will gradually get rid of coins, which will put pressure on the price.

At the same time, given that quite a lot of time has passed since the unlocking date (03.06.2023) to the present, and the coin has managed to update its highest-highs twice during this time, it is possible that these fears have not come true.

Technical Analysis: Support & Resistance Levels for SUI

Technically, we are certainly observing the strongest local bullish trend.

The resistance level is located at $2,18 - local highs from 27.03 and 24.10.

Accordingly, the local support level is located on the trend line, i.e. approximately at $1,93.

There is also an intermediate support level formed by the maximum from 14.02.2024.