🚀 SOL on the Rise: 4 Weeks of Growth & ETF Buzz!

Solana (SOL) has seen impressive growth, with a 10% increase last week and an additional 3.5% this week. Investors are eagerly awaiting the potential launch of a Solana spot ETF, and market analysts are weighing in on its impact.

Will the bullish momentum continue? Here’s a deep dive into the latest developments, technical analysis, and what lies ahead for SOL.

📈 SOL’s Impressive Growth Streak

Over the past week, SOL has grown by more than 10%, and this week the growth is about 3.5%. Thus, it is already practically possible to state that the bulls have guaranteed themselves growth for 4 weeks in a row. Currently, the price of SOL is trading at $150,2.

The key fundamental event, to which all the attention of traders is now riveted, is, of course, the possible launch of the Solana-ETF spot.

In this regard, the opinion of Bloomberg analysts is quite interesting. They believe that the Democratic Party in the United States is currently not very keen on being anti-crypto.

💡 ETF Speculations & The US Political Climate

Firstly, the elections will take place in almost 1 month, and, secondly, the contender for the post, D. Trump, is quite actively promoting the topic of crypto.

Let’s remember how not so long ago he treated visitors to PubKey, paying for his order with bitcoins. By the way, PubKey itself has been declared a bar for crypto enthusiasts and traders.

Accordingly, a certain window of opportunity has appeared for those companies that plan to launch spot ETFs, and the liberalization of cryptocurrency transactions may be given the green light for some time.

At the same time, some skeptics are confident that the probability of the SEC approving this ETF is still quite low.

🔍 GSR’s Scenarios for SOL’s Future

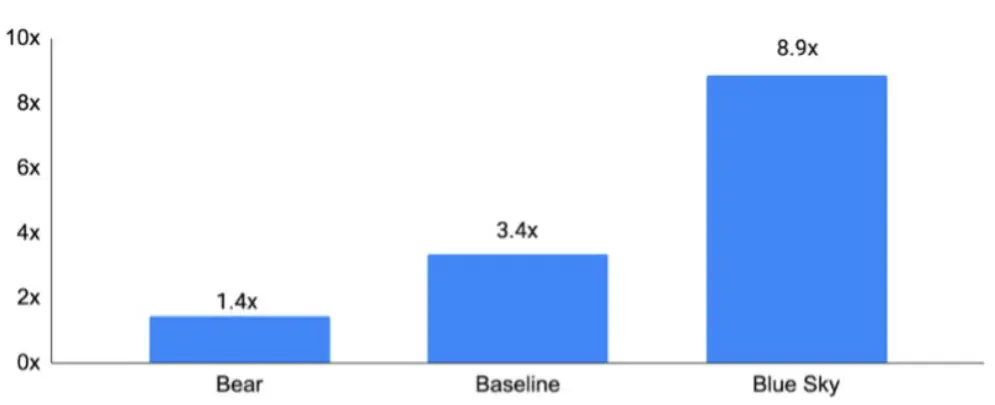

Meanwhile GSR assessed the growth potential of SOL in the event of an ETF launch. In all three of its scenarios, presented under the names Bear, Baseline, and Blue Sky, the company’s analysts expect the price to rise.

Bear’s scenario assumes that the allocation to investment products based on SOL will be 2% of the capital of similar products for Bitcoin. Baseline assumes a share of 5% of the capital, and, accordingly, Blue Sky implies a 14% share.

Meanwhile, as GSR cautiously, and in our opinion, quite rightly, notes, Solana is unlikely to be able to repeat the Bitcoin success.

📊 Technical Analysis: Key Levels to Watch

Technically, for SOLUSD, in our opinion, everything is going well. The probability of continued price growth is still significantly higher than the probability of a decline.

The support level for the price is in the range of 120,4 - 127. The resistance level is currently at the level of the local trend line, i.e. at $154.

If the bulls manage to push through this mark, the next target for the price will be the range of $162-165, which may be followed by an exit to recent highs at around $190-200.