BNB Price Rally: 18% Gains and New ATH Targets’

BNB’s Third Month of Gains

BNB has climbed 18% since early September, marking the third straight month of gains.

YTD, the token’s best month was July, when the price action pumped 19.2%. BNB is currently testing new ATHs.

Binance Partnerships Fuel Demand

Crypto market experts figure that the strong uptrend stems from a partnership between Binance and Franklin Templeton, which has boosted the token’s brand recognition.

Additionally, the popularity of the Aster DEX exchange, promoted by Binance’s founder, is on the rise.

As a result, demand for the BNB token has soared.

Market Headwinds: BTC, ETH, and Metals

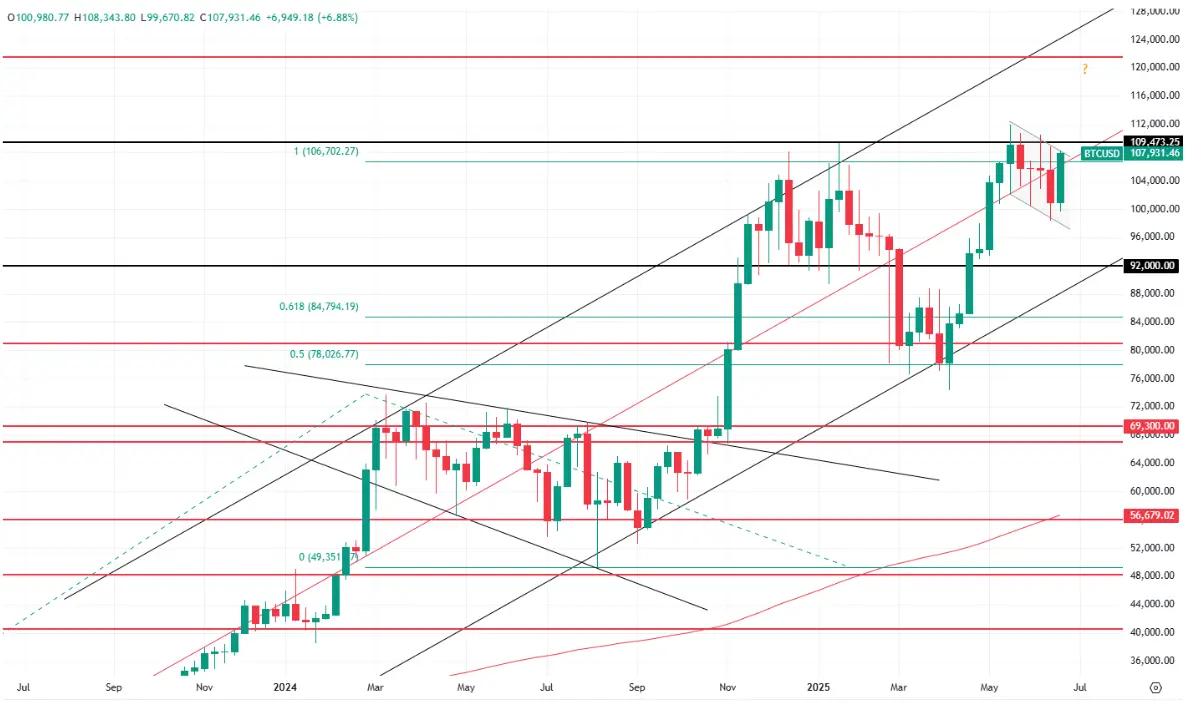

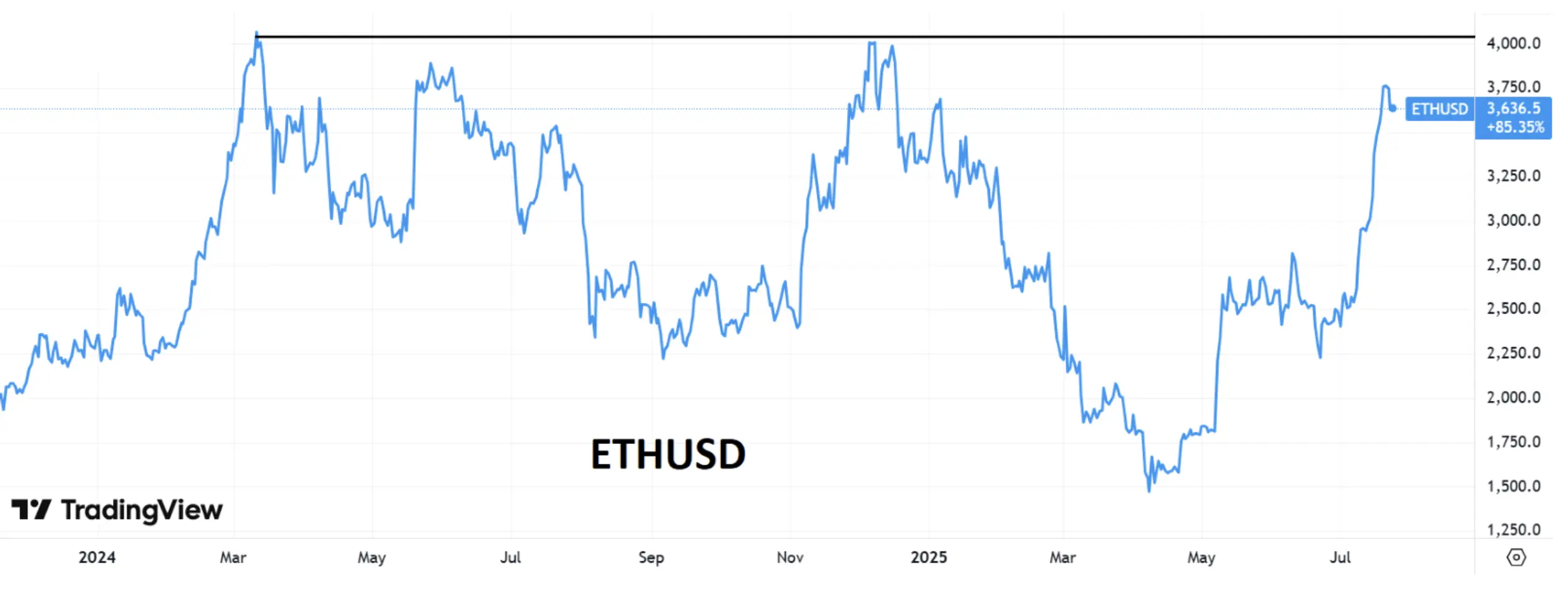

Meanwhile, bearish sentiment has dominated the cryptocurrency market in recent days.

For instance, BTC and ETH has been trending lower this week. Coinglass estimates that over 400,000 traders had their positions liquidated on Monday, September 22.

The change of heart is reportedly attributable to an accelerated shift of funds into precious metals – above all, gold and silver, which have been setting a string of nose-bleed ATHs.

The BNBUSD rate dipped 5.3% on Monday, September 22, the worst performance since April 6, before reversing higher.

Technical Outlook for BNBUSD

Technically, the daily chart shows that the regression channel still has a positive bias.

BNBUSD has pulled back from the upper bound of the channel for the time being.

An extension of the recent rally would see the bulls pushing for the recent high at USD 1,087.3.

In the event of a breakout, the next target could be USD 1,150.

Alternatively, a pullback towards USD 900 could be in the cards, but even in that case, the token would still keep trading within a broader bullish trend.