Bitcoin’s September 2024 Recovery: Will the Bullish Trend Continue? 🚀

During the current month, Bitcoin has partially restored its positions lost in August.

Let us recall that in August 2024, the coin fell by 8.7%, falling even below $50,000 (February 2024 levels).

In September, growth is still around +4.8% and it seems that there is still a chance of continuing the upward movement.

August’s Fall Below $50K 📉

In August 2024, Bitcoin experienced a significant drop, losing 8.7% of its value. For the first time since February, the coin dropped below the $50,000 mark. This decline caused concern in the market, especially after a bullish start to the year.

September Recovery and Hope for Growth 📈

September has brought some relief to Bitcoin holders, with the coin recovering by 4.8%. There’s growing optimism that the upward momentum could continue, but caution is still advised as the market remains volatile.

The FOMC Meeting and Its Impact on Bitcoin 🏦

Of course, the key event of the current month was the FOMC meeting of the Federal Reserve System and the decision on the key rate. The American regulator decided to soften monetary policy, reducing the rate by 50 basis points (bp) at once, an extraordinary step. The committee has only taken such measures a few times in particularly critical situations.

This decision has had a profound effect on the market, and many traders are now anticipating further stimulating policy from the Federal Reserve. With the expectation of continued rate cuts, there’s potential for Bitcoin to benefit as liquidity increases.

Changing Debt Structure: What It Means for Bitcoin 📊

Another interesting observation is the shift in the structure of US government debt holders. The Fed and non-residents are gradually losing their positions as key holders. Instead, a significant portion of buybacks is now provided by households through mutual funds and hedge funds. Given that this structure may not be strong enough, the Federal Reserve could respond by strengthening its quantitative easing (QE) program—buying back its government securities on the balance sheet.

This combination of rate cuts and increased QE is generally favorable for Bitcoin, as more liquidity and lower interest rates tend to benefit riskier assets like cryptocurrencies.

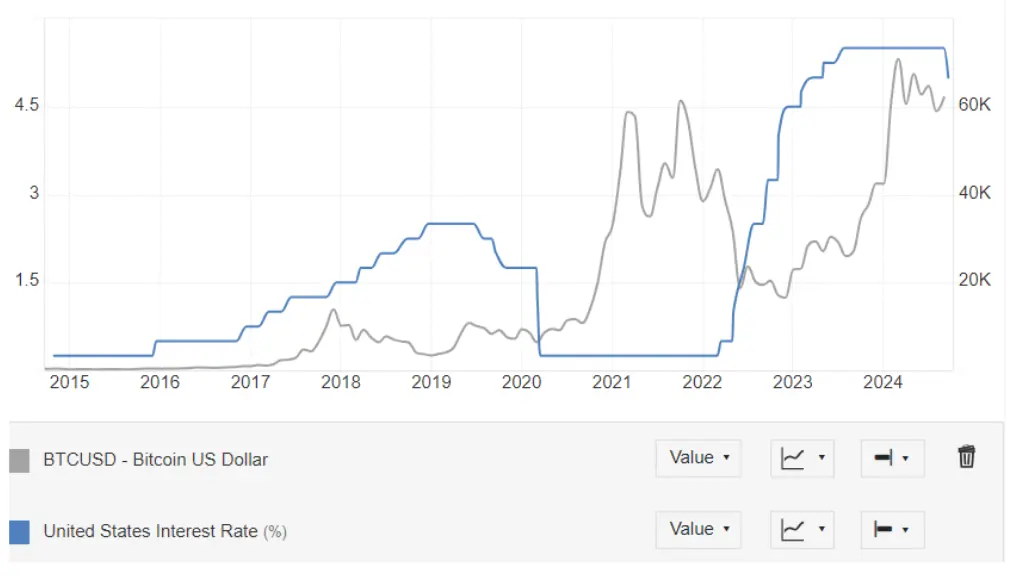

Historical Correlation Between Rates and Bitcoin Prices 🔑

Historically, Bitcoin has thrived in environments with low interest rates. Recall that, in 2021, Bitcoin reached its all-time highs during a period of record-low interest rates. The maximum price was updated again in 2024, but this time, it coincided with the highest key rate since 2001. However, many believe that the factor driving Bitcoin’s rally was the spot ETF approval. Now that the ETF catalyst has played out, Bitcoin has seen a gradual decline.

With the recent reversal in monetary policy, there’s renewed hope that Bitcoin could resume its bullish trend, potentially retesting its previous highs.

BTC’s Technical Setup: Is a Breakout Imminent? 📐

Technically, the BTCUSD regression channel is still directed downwards, indicating a classic downtrend. However, Bitcoin recently tested and bounced off its 200-day moving average, a key technical level that has historically provided strong support.

For the bullish scenario to be confirmed, Bitcoin needs to break through the upper boundary of the price channel, currently sitting at $62,250. Even more encouraging would be a breakthrough of the recent local maximum at $64,970. Until these levels are surpassed, traders should remain cautious about opening long positions.

Conclusion: Wait for Confirmation Before Going Long 💡

While the combination of rate cuts, increased QE, and technical support at the 200-day moving average are positive signs for Bitcoin, the market has yet to provide a clear confirmation of a bullish breakout. The key resistance levels need to be broken before we can confidently say that the bullish trend is back.