Bitcoin Ends FY2025 Lower After Two Years of Strong Gains

Bitcoin closed 6.2% lower in FY 2025, marking the first decline after two straight years of gains.

To remind, the token soared over 270% in 2023 through 2024.

Bitcoin’s FY2025 Performance in Context

Bitcoin’s strongest gains last year were recorded from April to July, with April standing out as the most bullish month, when the price action climbed 14.1%.

BTC mostly consolidated during H2 2025, before turning south by year-end.

Bullish vs Conservative Price Targets

Analysts are divided over Bitcoin’s medium-term outlook.

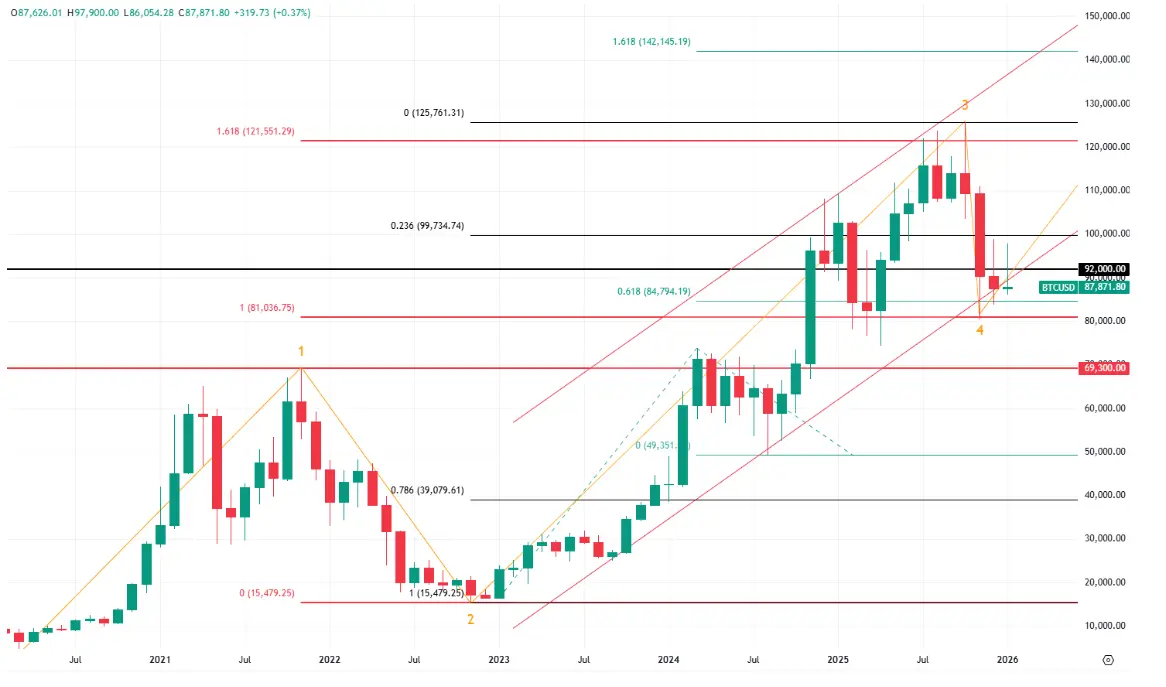

The bullish scenario envisions hitting $150-200K as early as this year. Our forecast is more conservative, with the upside target at $140K.

BTC dipped 7.5% over the past week before rebounding again since Monday’s open on the back of several factors, including dollar weakness.

Key Technical Levels and Risk Scenarios

Technically, our previous overview factored in the odds of a breakdown below the $80.5k mark.

If that plays out, the price could pull back further into the $65-70.5k range.

The alternative scenario called for the token to end the correction and retrace to an upward track.

What Comes Next for BTC

So far, the flagship crypto currency has sidestepped a deeper correction, let alone a breakdown of $80.5k.

On the flip side, there are no signs of a sustainable rebound or a retracement to higher levels either.

As a result, it still remains to be seen which direction the token will take going forward.