Bitcoin Consolidates at $100K as Amazon Considers BTC Reserves

Recent Price Action: BTCUSD Tests New Heights

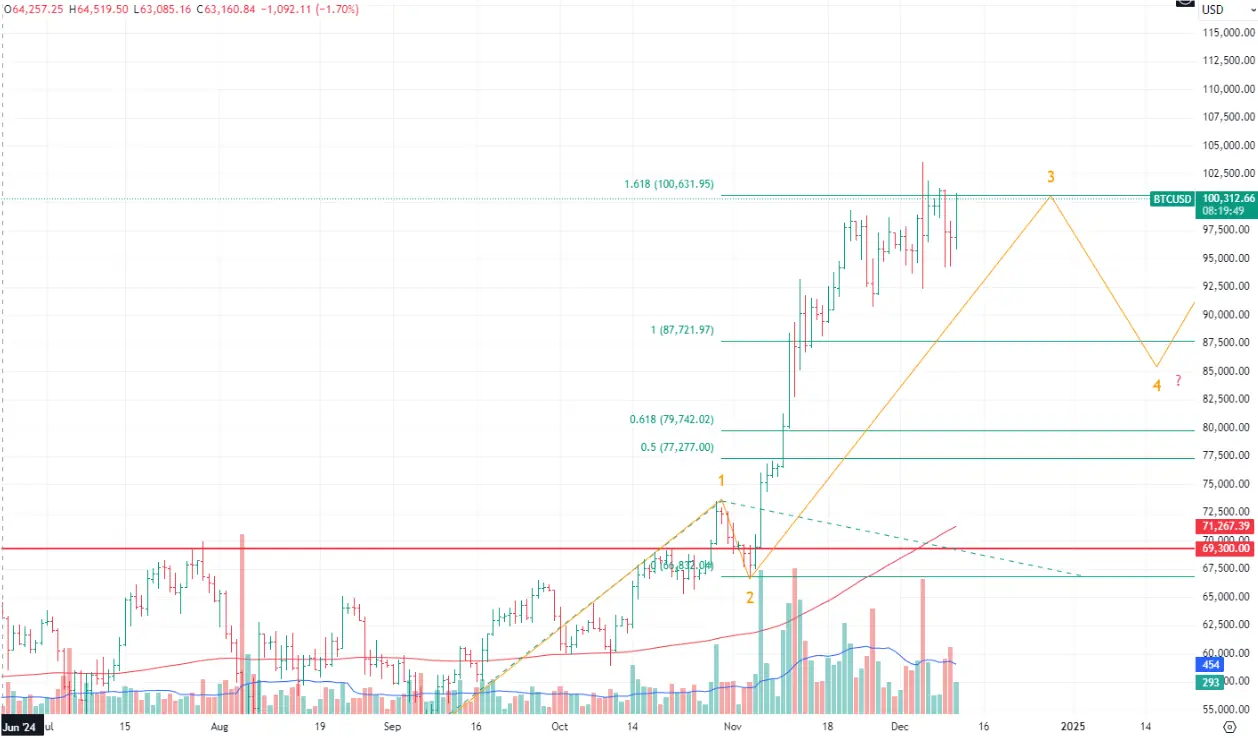

BTCUSD is down 2.4% so far this week. The price action has been consolidating around the $100k mark since November 18. An ATH was reached on December 5 when the price peaked at $103,647.

Institutional Interest Growing: Amazon’s Bitcoin Reserve Proposal

In industry news, free market think tank The National Center for Public Policy Research (NCPPR) submitted a proposal to Amazon, urging the company to create a Bitcoin reserve.

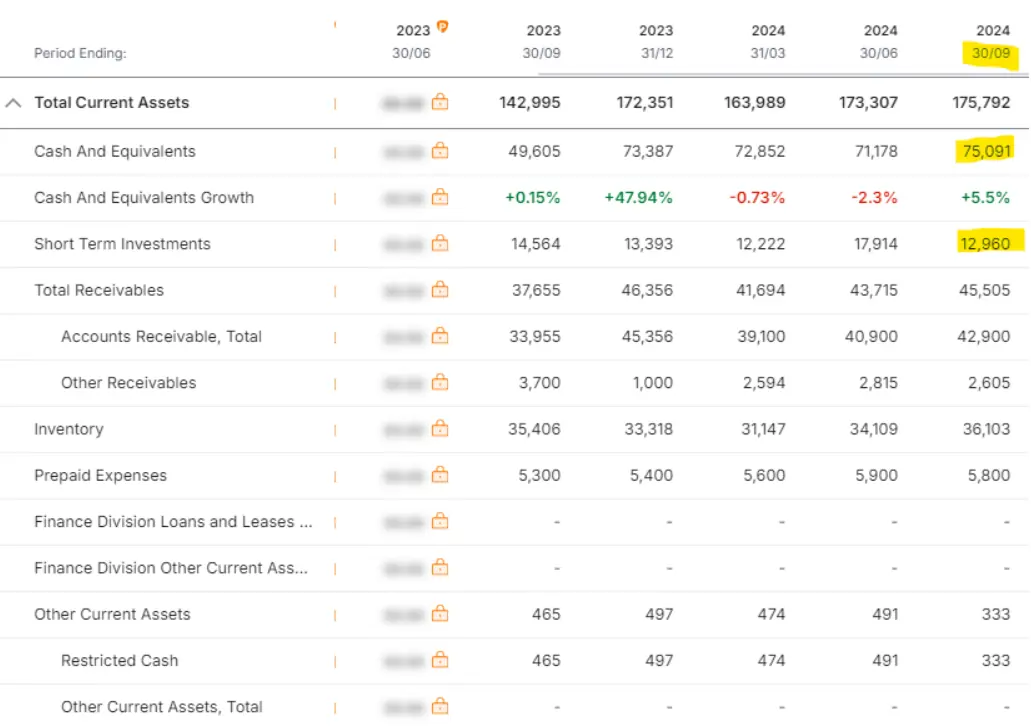

To remind, according to Amazon’s latest balance sheet, cash and cash equivalents totaled about $75 bn, while another $12 bn was parked in short-term investment instruments.

Accordingly, Amazon’s shareholders are considering the think tank’s proposal to invest these funds in cryptocurrency.

This issue will be on the agenda of a shareholders’ meeting in 2025. Needless to say, a positive decision would exert a positive impact on the BTC price.

State-Level Adoption: Alabama’s Strategic BTC Initiative

Incidentally, the Alabama state auditor general Andrew Sorrell also proposed building up a strategic BTC reserve.

Cryptocurrency is a global asset class currently worth more than $3 tn, over which the state has no influence.

It is also the fastest-growing asset class with the greatest potential for price growth, Sorrell claims.

ETF Impact: Trump Election Drives $10B in Bitcoin Inflows

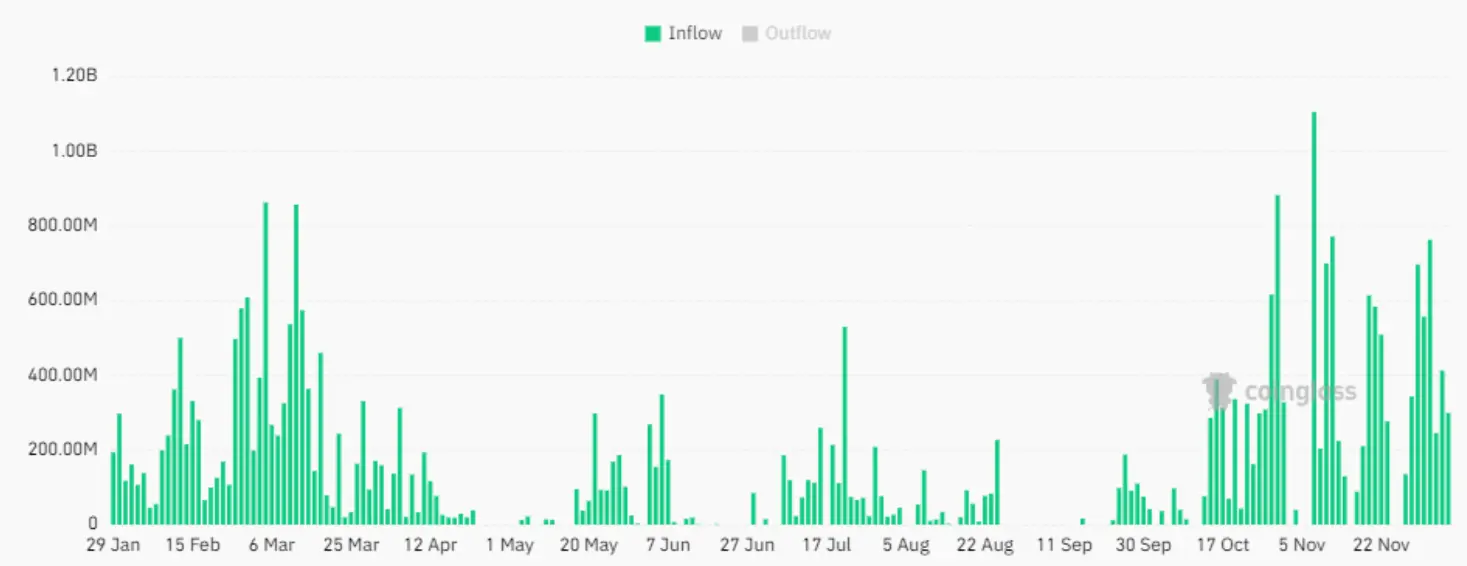

Meanwhile, experts believe that US Bitcoin ETFs have attracted inflows of approximately $10 bn since the election of Donald Trump.

More precisely, inflows totaled about $ 9 bn from November 6 to December 4, while the total allocation would be about $14 bn starting from mid-October, i.e. more than 40% of all inflows since the launch of spot BTC ETFs. This is quite an impressive number.

Technical Analysis: Wave Pattern Scenarios

Base Case: Completion of Third Wave

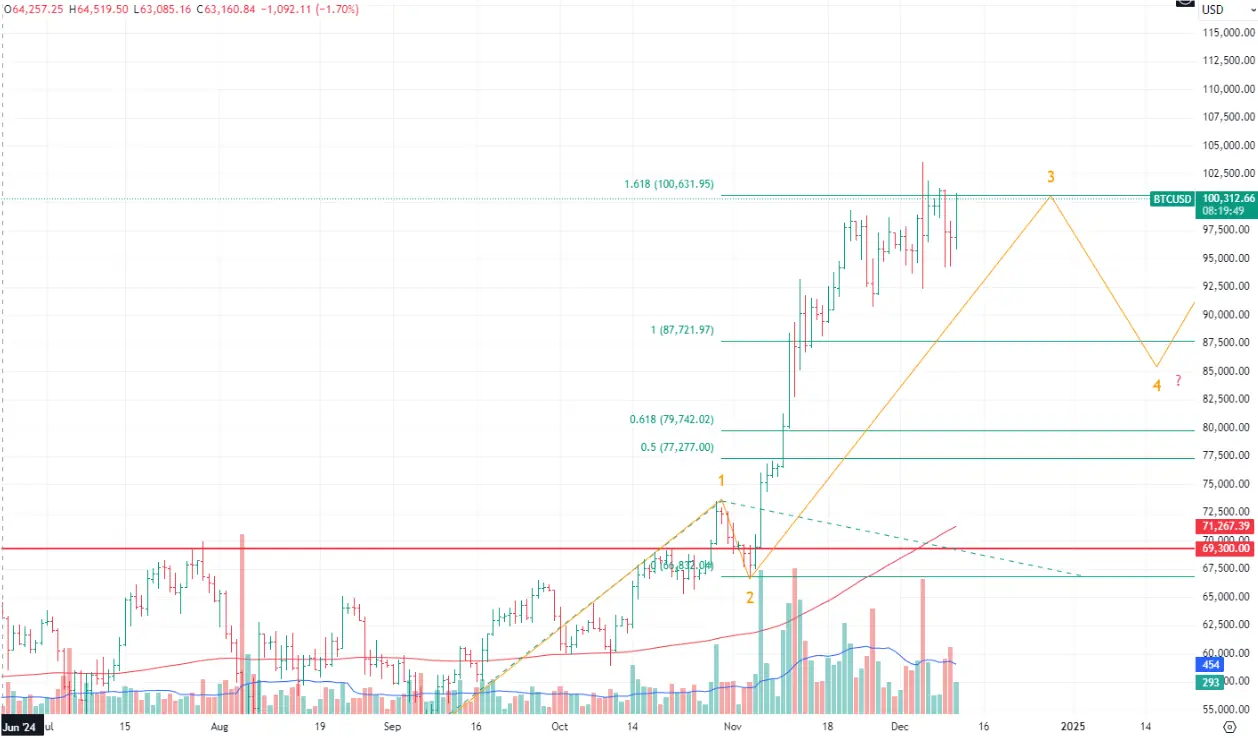

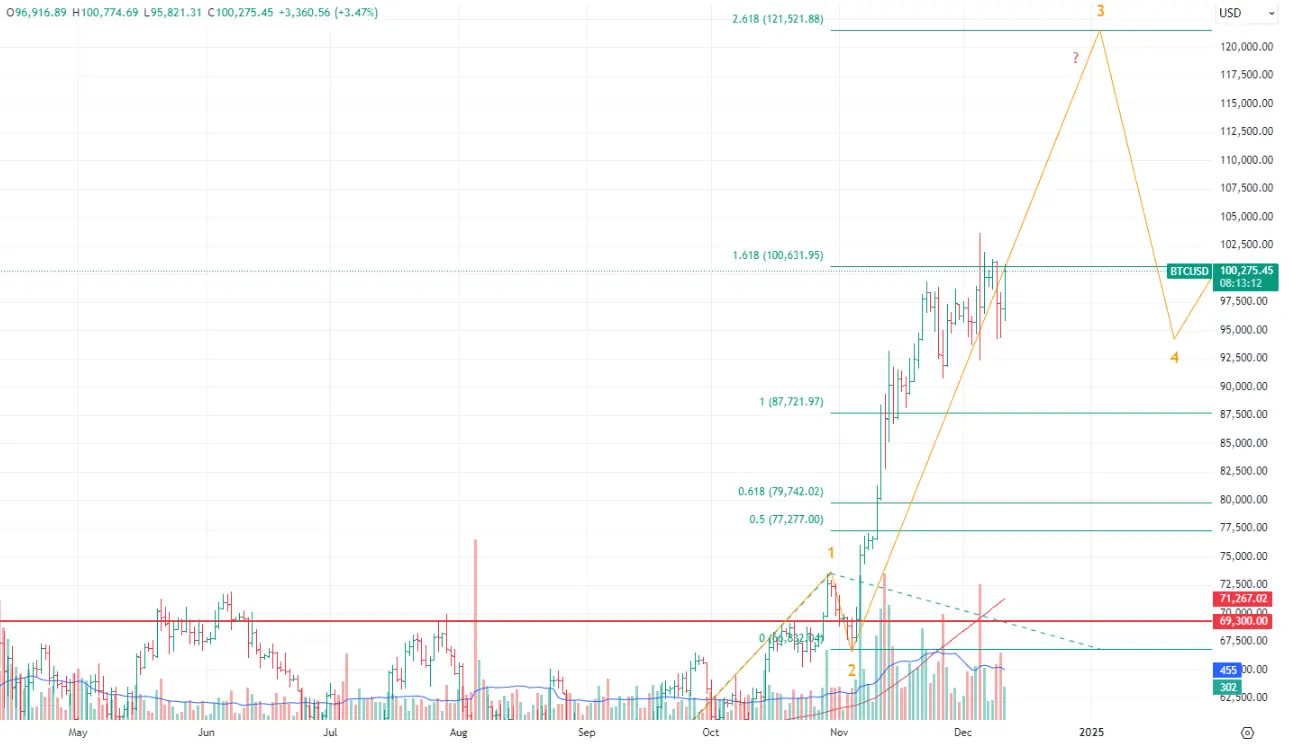

As for the price of BTCUSD, the most likely scenario, as we noted in a previous overview, is that the price action is in the third impulse wave and could reach completion soon.

As for the price of BTCUSD, the most likely scenario, as we noted in a previous overview, is that the price action is in the third impulse wave and could reach completion soon.

This does not mean that the bullish trend is over, but it does imply that before resuming its ascent, BTCUSD could revert to a correction. The target of the correction could be in the range of $84-85k.

Alternative Scenario: Extended Bullish Movement

An alternative scenario also worth considering is the continuation of the current price movement, i.e. the third wave may be even longer than previously assumed, and it could reach the 261.8% Fibonacci extension of the first wave.

An alternative scenario also worth considering is the continuation of the current price movement, i.e. the third wave may be even longer than previously assumed, and it could reach the 261.8% Fibonacci extension of the first wave.

This would shift the upside target to slightly above $120k, and a potential correction could lead to a subsequent decline in BTCUSD below the $100k mark.

This bullish scenario can only be considered if the price retraces to recent highs, i.e. if the price action breaches the current range of $90-102k to the upside.