Bitcoin Breaks $100K: May Rally Continues as ETF Inflows Surge

Bitcoin’s Market Performance: Breaking the $100K Barrier

Bitcoin ended April with a 14% gain. Since early May, the token has been trading in the green, up over 10%.

The standout event for the top token this month was its breakout above $100k, finally reclaiming the earlier milestone.

Fed Policy Impact and Market Response

The breakthrough occurred on May 8, when Bitcoin soared 6.3% in a single trading session, likely spurred by the Fed’s decision to hold its key interest rate steady.

A similar pattern played out in March 2025, when officials maintained the Fed funds rate in the target range of 4.25-4.50%.

That decision triggered a short-lived but positive market move.

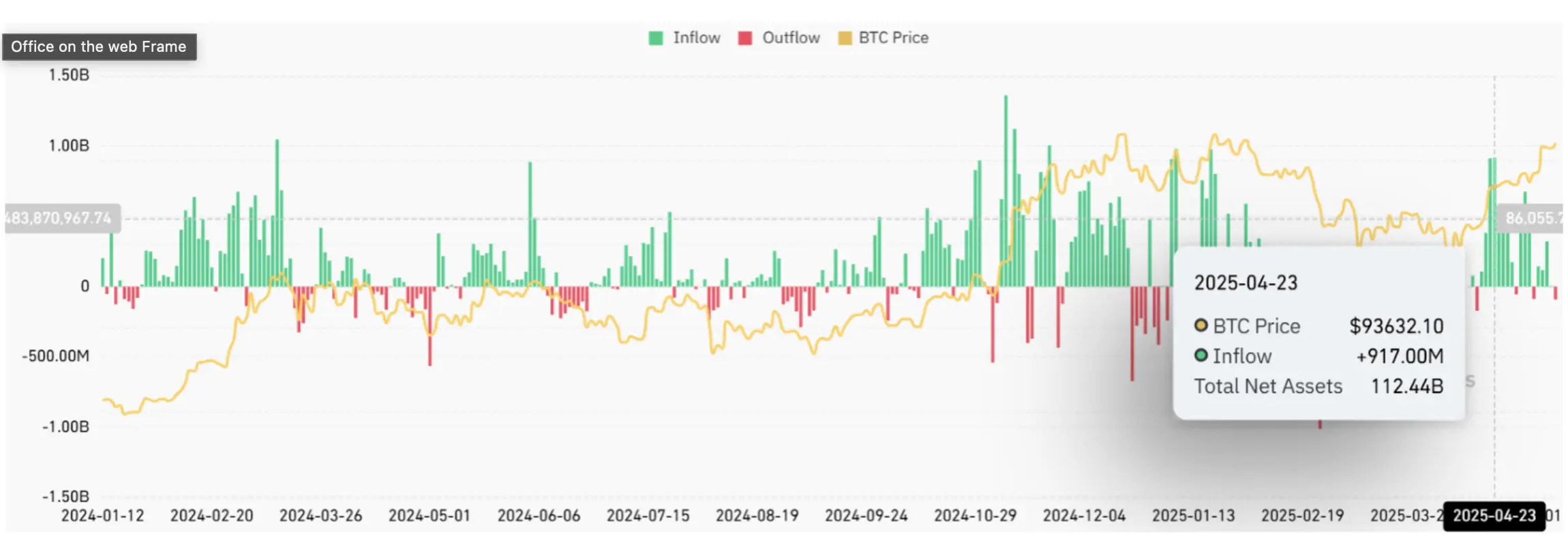

Analysts are pointing to an upsurge in capital flows into crypto ETFs.

The 90-day trade truce between the US and China may have also fueled growing interest.

According to CoinGlass, the peak net inflow hit around late April.

The Fear and Greed Index currently stands at 73.

Technical Analysis: Wave Patterns and Price Projections

From a technical perspective, classic wave analysis is worth revisiting.

As noted in one of our overviews a month ago, two scenarios could be at play.

In the bullish case, the price action keeps climbing and eventually forms the fifth impulse wave.

The target for this rally could reach $121,500, with headroom for even more upside.

This scenario would gain traction if Bitcoin sets new ATHs above $109-110k, which so far has not materialized.

That said, the odds of this playing out look quite strong.

Bull vs. Bear Scenarios: What’s Next for Bitcoin?

The bearish scenario, on the other hand, sees the price dropping below $65-70k.

This has not shaped up either but remains on the table.

Notably, our count of the fourth wave’s completion might be flawed, meaning the price could still dip to $75k, although such a turn of events looks unlikely at this point.

Another key point is the nature of impulse wave formation.

Under the classic Elliott Wave theory, the internal structure also tracks a five-wave pattern.

This suggests that even if a correction breaks out, it would be premature to predict the end of wave impulse.

Overall, we reiterate out cautiously optimistic outlook for Bitcoin’s price trajectory moving forward.