Aster Token Faces Sell-Off Risks Amid Whale Control

Aster’s Recent Decline: Two Weeks of Gains Erased

The Aster token has shed over 5% since Monday’s opening on Monday, October 29, reversing lower after two weeks of gains.

Crypto experts are divided over Aster’s near-term outlook.

A big chunk of tokens is concentrated in just six wallets, raising the odds of price manipulation as well as of a major stake getting dumped followed by a steep price decline.

Upcoming Token Unlock Could Add Selling Pressure

Aster watchers also flag that a hefty portion of tokens – just over 10% of the total supply – is scheduled for an unblock in October.

Therefore, a potential sell-off could step up downward price pressure.

Binance Connection Offers a Glimmer of Hope

On the flip side, Binance founder Changpeng Zhao reportedly acts as an advisor for the decentralized exchange Aster.

This development comes as an extra driver for the token’s upside on crypto platforms

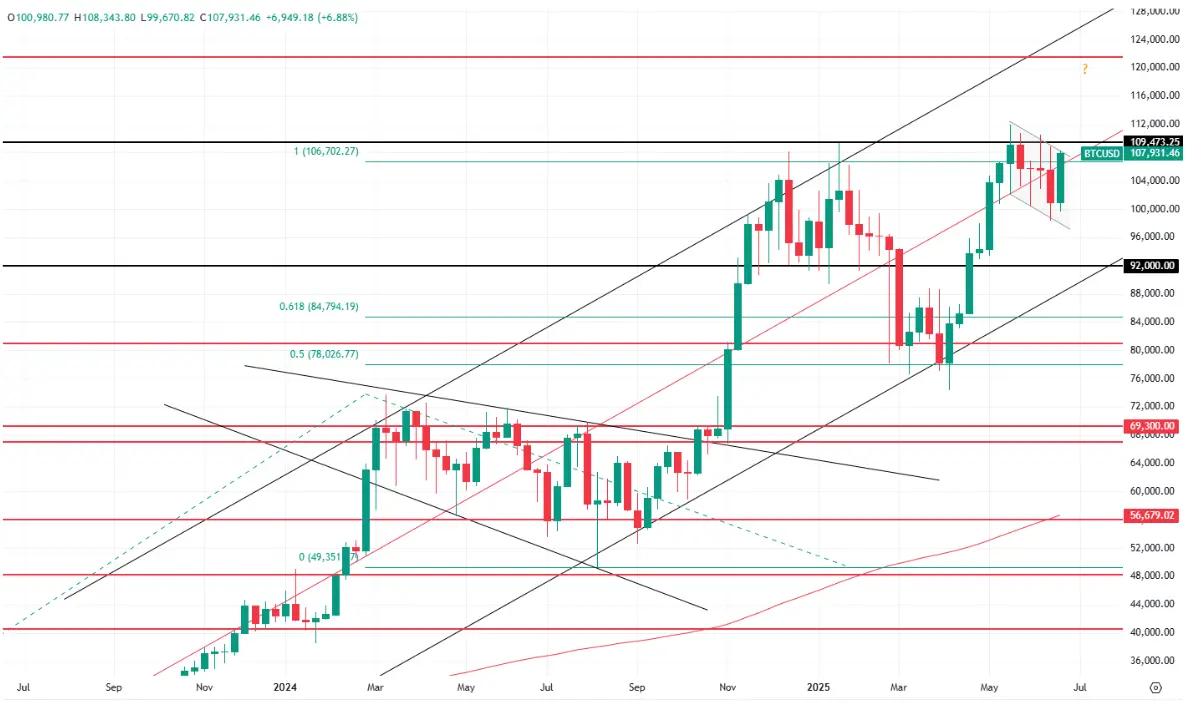

Technical Outlook: Key Fibonacci Levels to Watch

From the TA standpoint, Aster currently trades within a channel, which reveals a downward bias, signaling a short-term bearish trend.

The price action has dipped below the 38.2% Fibonacci retracement at 1.7168.

The token even briefly flirted with the next 50% retracement level at 1.4946, but the bears failed to stage a breakdown.

Two scenarios look plausible for the time being. Under the most plausible scenario, the Aster price is seen extending the downturn, sliding to 1.4946 and then breaching this mark.

The next downside target could shape up at 1.27720 where the key 61.8% Fibonacci retracement lies.

The more optimistic scenario calls for the Aster token to rebound towards and then break out of the upper bound of the trading channel at 1.8550.

Going forward, the bulls could set their sights on 1.9920.